Menu

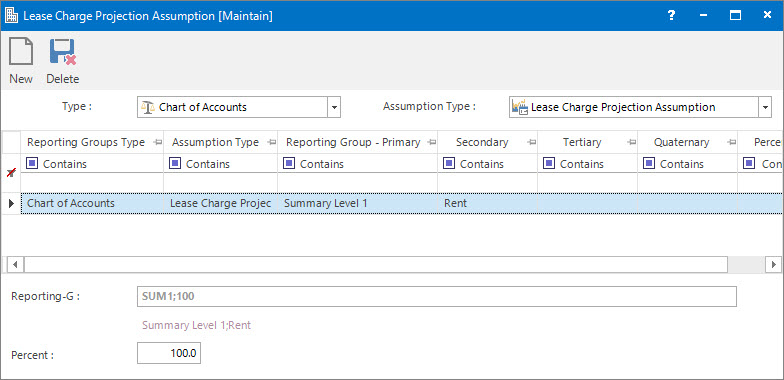

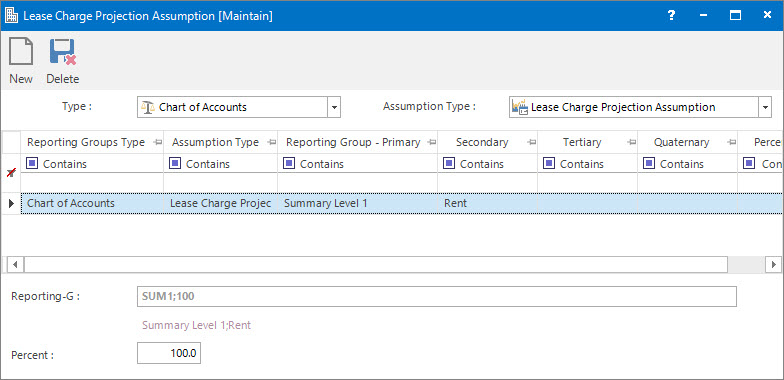

| File | > | Financial Setup | > | Assumptions | > | Reporting Group Assumptions |

Mandatory Prerequisites

Prior to entering Lease Charge Projection Assumption figures, refer to the following Topics:

Screenshot and Field Descriptions

Type: this is the type of Reporting Group Assumption. The only option available for this field is the Chart of Accounts type which is displayed by default.

Assumption Type: this is the type of assumptions to be selected. The options are:

- Accruals: this refers to adding the assumptions for the Accruals process.

- Lease Charge Projection: this refers to entering the assumptions to be used in the Lease Charge Projection function.

Lease Charge Projection Assumptions table: this is table displays the percentage figures for the type of assumptions based on the Reporting Groups for Chart of Accounts.

Reporting-G: this is the reporting group Chart of Account for the assumption.

Percent: this is percentage to be used as the assumption for the selected reporting group Chart of Account.

How Do I : Add a new Lease Charge Projection Assumption percent

How Do I : Modify an existing Lease Charge Projection Assumption percent

How Do I : Delete an existing Lease Charge Projection Assumption percent

Lease Charge Projection Assumption figures are associated with the following Topics: